A product's lifecycle phase largely dictates the strategy in software product development. However, during the lifecycle, there are several ways to diversify investment risks to avoid insurmountable challenges by the time the product reaches the end of its lifecycle.

A Balanced Portfolio

Portfolio management is emphasized in corporations. Managing a product portfolio is not just about overseeing a collection of products but also about balancing different markets and product lifecycles.

This balancing involves anticipating market changes and product lifecycle stages: growth, cash cow, decline, and end-of-life. The goal is long-term success and continuity. Over the long run, this approach requires active decisions to phase out products and invest in renewal.

The same thinking can be applied on a smaller scale in product development.

Product Lifecycle

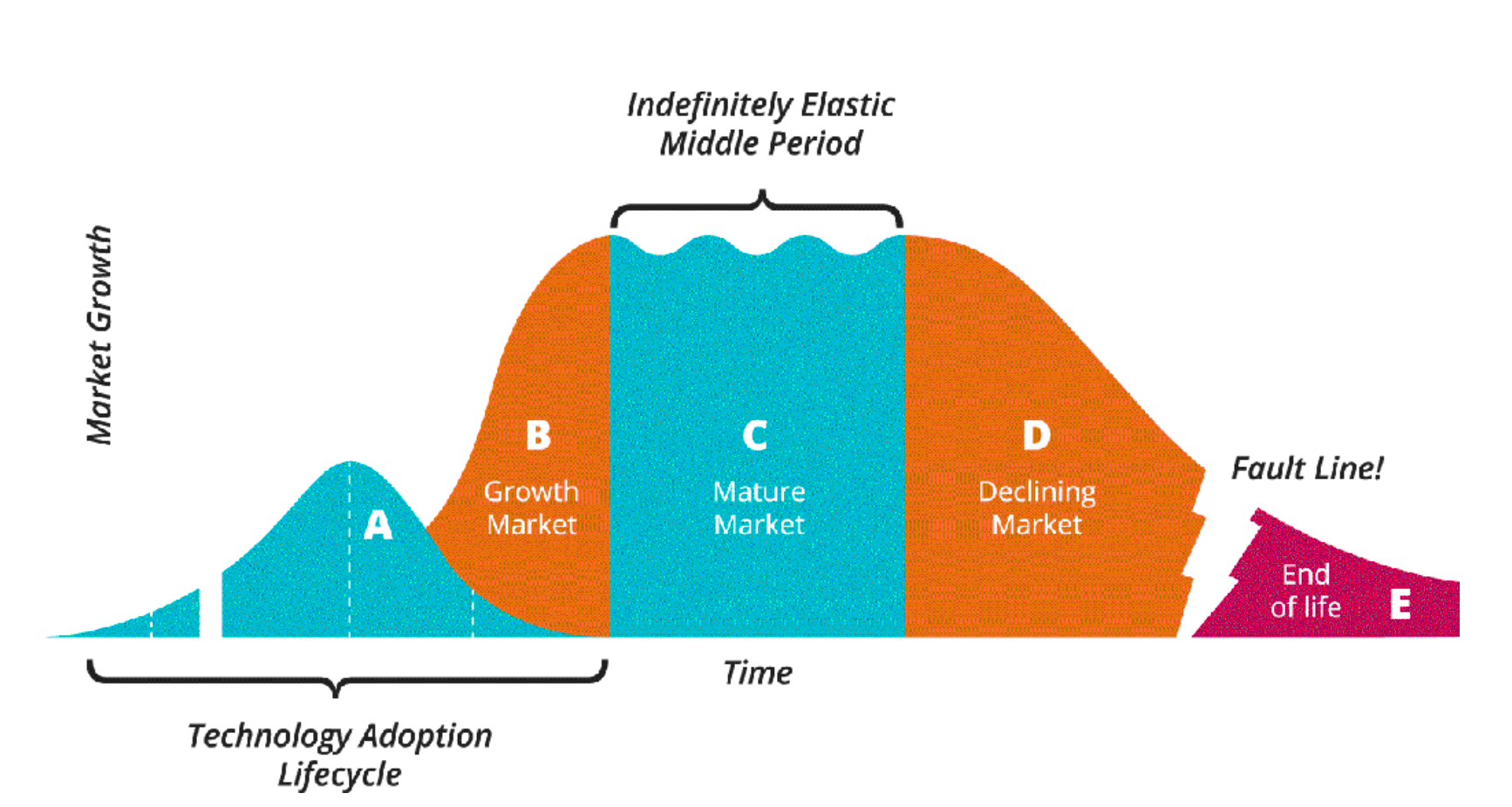

All products eventually reach their end. After the growth phase comes the cash cow phase, where customer growth stagnates, but existing customers provide sustainable revenue. After that comes the decline phase, during which most customers leave the product.

How quickly a product transitions through these phases depends on the market and competition. For this reason, monitoring the market and remaining competitive is essential for extending the growth and cash cow phases as much as possible.

However, decline and end-of-life are inevitable. To address this risk, it is wise to invest small but consistent resources into new product ventures and business models.

Guidelines for Diversifying Development Investments

Here’s a general guideline for diversifying product development investments:

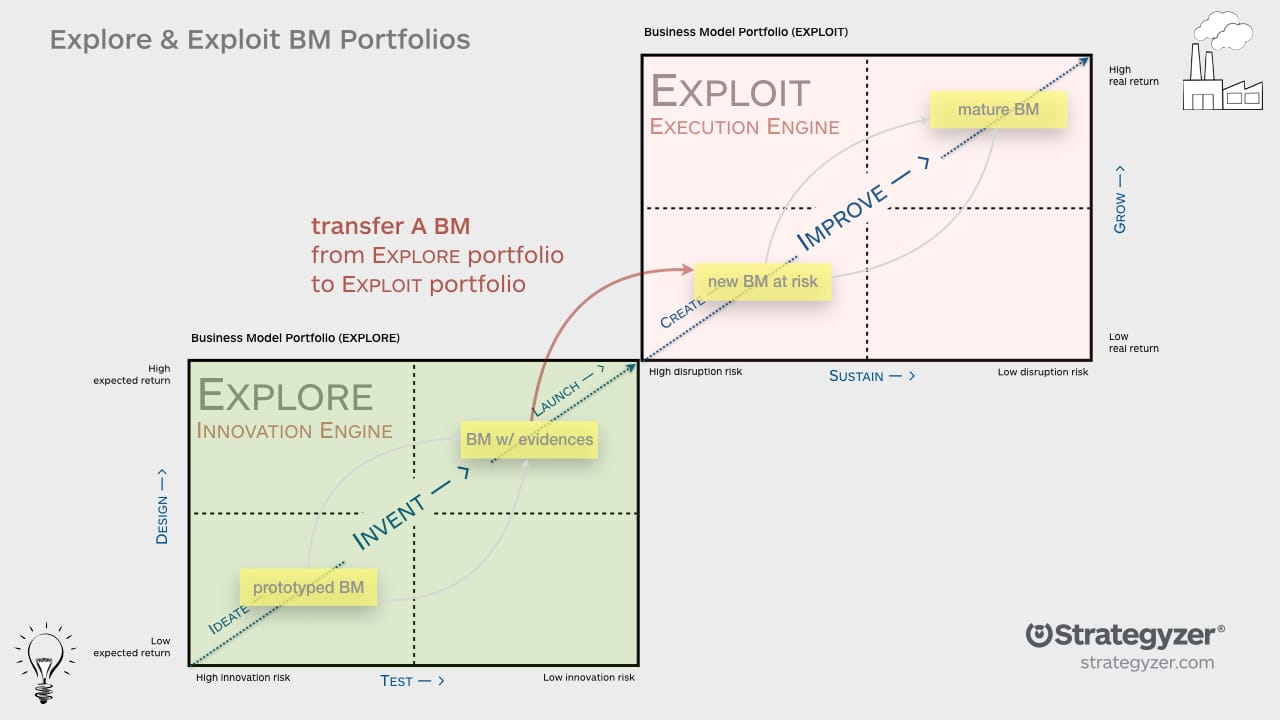

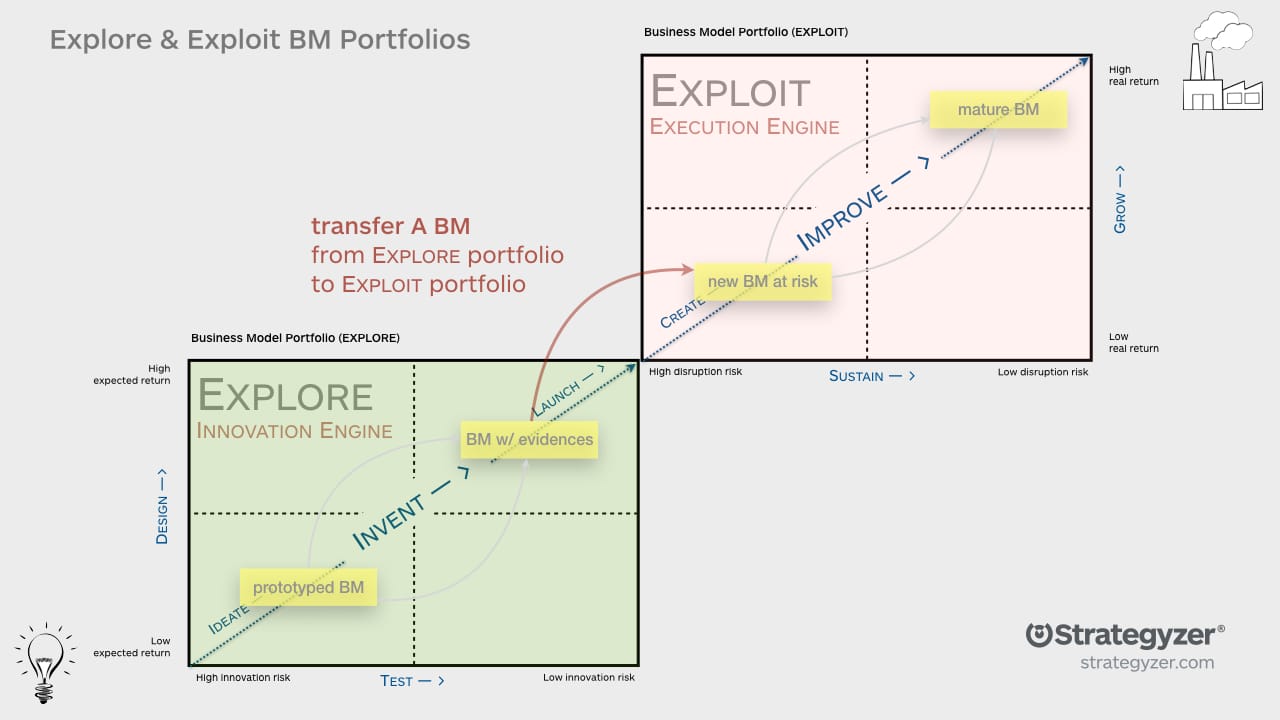

- 5–10% for new product ventures

- 20% for renewal efforts, such as entering new markets or finding new applications for the existing product

- 60%+ for competitiveness and growth

- Max 20% for maintaining the existing product

This guideline is compiled from multiple sources and is adaptable. Exact figures should be fine-tuned based on specific use cases.

Why Invest in New Product Ventures?

Investing in new product ventures prepares for the moment the current product ends its lifecycle.

Creating new product ventures is highly uncertain work. Nine out of ten product startups fail. Therefore, risk diversification across multiple ventures is needed. This process requires significant calendar time, which is why it’s never too early to begin investing.

Why Invest in Renewal?

Surprises can happen in the market of the current product. Similarly, attractive adjacent markets may emerge, which could prove more sustainable and require only minor additions to the existing product to enter.

This 20% investment focuses on the current market for a product in the growth phase. In other lifecycle stages, it reminds us to diversify investments to mitigate risks.

Investing in Competitiveness and Growth

This is a no-brainer in the growth phase. However, it remains a critical investment to extend the lifecycle during the cash cow phase.

It’s worth noting that only 20% of the investment in this model is allocated to maintenance. If maintenance consumes a larger share of the development organization's capacity, renewal investments should target eliminating technical debt. This reduces the need for maintenance, freeing up capacity for genuine competitiveness and renewal investments in the future.

Is Product Renewal or Risk Diversification Relevant for You?

At Flowa, we specialize in renewal partnerships for software product development. We are happy to assist with technical debt reduction, technology and platform modernization, and coordinating and prioritizing new investments.

Get in touch to discuss your needs and goals!